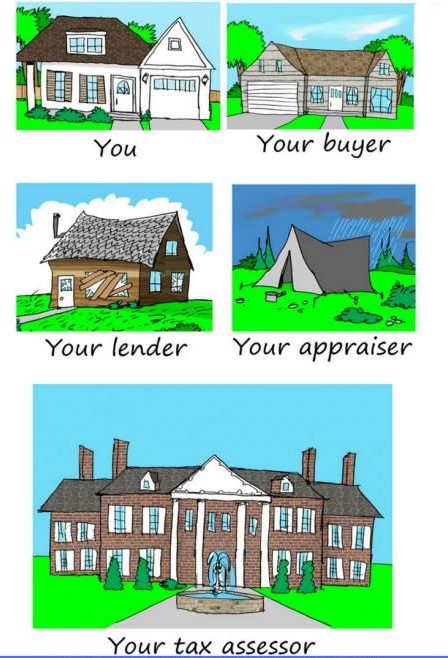

Your Home As Seen By.........

Grievances & Assessment appeal services

Most localities determine your property tax burden based on an ad valorem assessment of the property's value. If you you get an unwanted surprise in the mail stating your taxes are going up, you may have good reason to differ with their assessment. Sometimes, matters like this can be solved with a phone call. However, if after discussing your assessment with your local taxing authority you still feel your property was overvalued, an independent, third-party appraiser is often your best bet in proving your case.

There are as many different procedures for appealing assessments as there are property taxing districts, so it's important to enlist the help of a professional appraisal firm that's experienced and trained in the ins and outs of your particular jurisdiction.

2026 Grievance periods:

Westchester County: June 1st to June 16th

Putnam & Dutchess County: May 1st to May 26th

NY State Department of Taxation & Finance

How to Contest Your Assessment: Explains the Grievance Process

Contest your assessment (ny.gov)

Municipal Profiles: Find Your Town's Assessment Information

MuniPro Index-New York State County Map (ny.gov)

Please note: With some quick and free research, I can determine whether or not there is a case for a reduction. If there is no case then, you have no need to waste your time and money on an appraisal or hiring a tax representative. If there is a case, then I can provide you with an appraisal to file with your grievance or if you prefer, I can file a grievance for you. If you are denied a reduction, I can file a Small Claim Assessment Review (SCAR) and represent you at a hearing if necessary. If there is a hearing on your case, you may need the appraiser you've hired to testify on your behalf. With over 40 years of valuation experience, I am able to professionally and persuasively testify at appeal hearings. Contact me for a free assessment evaluation to find out whether you may have a case for a grievance and possibly a substantial tax reduction.

|